Portfolio Information Tab

This tab contains basic information about the Portfolio Company. Fields in this tab along with their description are given below.

Summary Information

| Investee Company Name | Provide name of the Investee Company. This field is mandatory. |

| Date of Investment | Select Date of Investment. |

| Assigned To | Shows the User or Group to which Portfolio Company is assigned. |

| Created Time | Shows created Time of Portfolio. |

| Exit Completed | Checkbox to select Exit Completed status of Portfolio. |

| Portfolio Code | Shows auto-generated code of the Portfolio. |

| Business Description | Provide description about the Portfolio company. |

| Modified Time | Shows last modified Time of Portfolio. |

| Created By | Shows created by of the Portfolio. |

| Exit Date | Select Exit Date of Portfolio. |

| NPL |

Deal Information

| Investment Currency | Select the Investment Currency of the Portfolio. This field is mandatory. |

| GP Office | Select General Partner's office location. |

| Deal Sector | Select sector of the investment. For example - Infrastructure, Finance, etc. |

| Deal Sub Sector | Select sub sector of the Deal based on sector selected earlier. |

| Investee Company Legal Name | Provide name of the Investee Company. |

| Stakeholding | Select Stakeholding e.g. Control or Minority. |

| Deal City | Select location (City) of the investment. |

| Deal Type | Select the Deal Type e.g. MBI, MBO, Startup, Growth, Follow on etc. |

| Listed Company | Select whether the company is Listed or Unlisted. |

| Transaction Type | Select the Transaction Type e.g. Primary, Secondary and Both. |

| GP Role | Select Role of the General Partner in investment e.g. Lead, Co-Lead or Follow. |

| Associated Deal | Select the Deal Associated with the Portfolio. |

| Deal Leader | This field shows user associated with the deal. |

| Investment Type | Select Investment Type e.g. Bond, Convertible Bond, Loan, Secured Loan, Unsecured Loan, Others. |

Investment entry Valuation and Financials

| FY (Year) | Select FY from the dropdown. |

| Revenue | Calculated Field. Shows Revenue of the Portfolio. |

| Enterprise Value | Provide Enterprise Value of the Portfolio. |

| Equity Value | Provide Equity Value of the Portfolio. |

| Entry EV/Revenue | Calculated Field. Shows Entry EV/Revenue of the Portfolio. |

| CCY | This field display Financials Currency of the Portfolio. |

| EBITDA | Calculated Field. Shows EBITDA of the Portfolio. |

| Net Debt | Provide Net Debt of the Portfolio. |

| Entry EV/EBITDA | Calculated Field. Shows Entry EV/EBITDA of the Portfolio. |

Entry Financials

| Date | |

| Revenue (Cr.) | |

| EBITDA (Cr.) | |

| PAT (Cr.) | |

| Networth (Cr.) | |

| Gross Debt (Cr.) | |

| Cash (Cr.) | |

| Shares O/s (m) |

Exit Financials

| Date | |

| Revenue (Cr.) | |

| EBITDA (Cr.) | |

| PAT (Cr.) | |

| Networth (Cr.) | |

| Gross Debt (Cr.) | |

| Cash (Cr.) | |

| Shares O/s (m) |

Health Status

| Current | Shows Current health status based on the current valuation of the investment. |

| Previous | Shows Previous health status based on the previous valuation of the investment. |

Investment Summary (Actual Cashflow)

| Investment at Cost | Calculated Field. Shows Investment at Cost. |

| Sale Proceeds Till Date | Calculated Field. Shows sales proceeds till date. |

| Dividend / Interest Income | Calculated Field. Shows total divident/interest income earned till date. |

| Current Cost | Calculated Field. Shows Current Cost of the investment. |

| Other Income | |

| Interest on Principal | |

| Interest on Interest | |

| Default Interest | |

| Total Realizations | Calculated Field. Shows Total Realizations till date. |

Investment Summary (Expected Future Cashflow)

| Follow-on Investment (Expected) | Calculated Field. Shows expected Follow-on Investment. |

| Dividend/Interest Income (Expected) | Calculated Field. Shows expected divident/interest income yet to be realized. |

| Sale Proceeds/Redemptions (Expected) | Calculated Field. Shows expected Sale proceeds yet to be realized. |

| Total Realizations (Expected) | Calculated Field. Shows expected Total Realizations yet to be realized. |

Valuation

| Current Valuation | Calculated Field. Shows Current Valuation. |

| Valuation Methodology | Shows Valuation Methodology used for the Current Valuation. |

IRR & MoC

| IC Case IRR (%) | Enter IC Case IRR % at the time of investment. |

| Current Gross IRR (%) |

Calculated Field. Shows Current Gross IRR (Internal Rate of Return) percentage. |

| Expected Gross IRR (%) | Calculated Field. Shows Expected Gross IRR (Internal Rate of Return) percentage. |

| IC Case MoC | Enter IC Case MoC (Multiple of Capital) at the time of investment. |

| Current Gross MoC |

Calculated Field. Shows Current Gross MoC. MoC stands for Multiple of Capital and is a measure of performance. It measures the proceeds received when an investment is sold, or the valuation of an investment is held, as a multiple of the original cost of the investment. |

| Expected Gross MoC | Calculated Field. Shows Expected Gross MoC. |

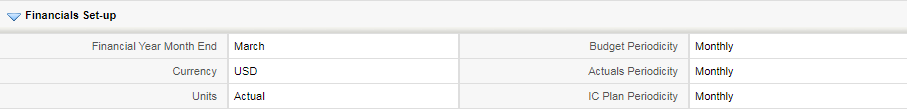

Financials Set up list view contains following details

- Financial Year Month End

- Currency

- Units

- IC Plan Periodicity

- Budget Periodicity

- Actuals Periodicity

To edit the details, hover the mouse on the field and click Edit.

Note: Once periodicity (i.e. frequency) has been defined and numbers have been uploaded then its not allowed to change the periodicity.

Address Information

| Mailing Address | Provide mailing address. |

| Other Address | Provide alternate address. |

Company Logo: You can browse and upload Portfolio Company's logo.

Company Picture: You can browse and upload Portfolio Company's Picture.

Comments Information: You can add comments to the portfolio.