Collateral Tab

This tab contains information about : Real Estate Collaterals, Corporate Collaterals, Shares Collaterals, Unsecured/Others Collaterals, Collaterals Summary. Collateral is something you put up as a security.Collateral is a property or other asset that a borrower offers as a way for a lender to secure the loan. If the borrower stops making the promised loan payments, the lender can seize the collateral to recoup its losses. Since collateral offers some security to the lender should the borrower fail to pay back the loan, loans that are secured by collateral typically have lower interest rates than unsecured loans.

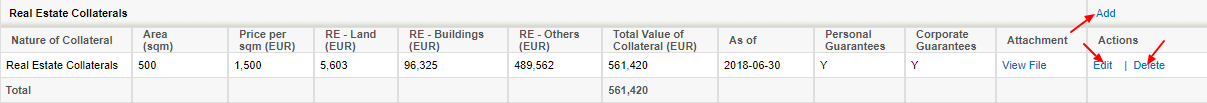

Real Estate Collaterals : When granting a loan, the financial institution requires guarantees. In the case of a loan secured by real estate, the title can not be transferred, since the borrower wants to either live in the house or rent it out.

You can add Real Estate Collaterals data by clicking the Add link in top right and Edit or Delete using links in the Actions column.

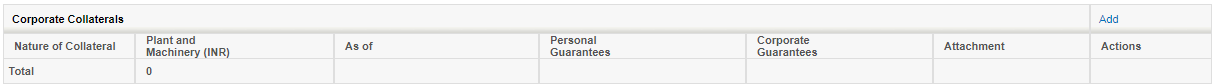

Corporate Collaterals : Corporate collateral is fundamental to making sure all salespeople (and any other

employees who have contact with current and potential customers) communicate your company's brand in a consistent

way. In Corporate Collaterals user need to give either Personal Guarantees or Corporate Guarantees.

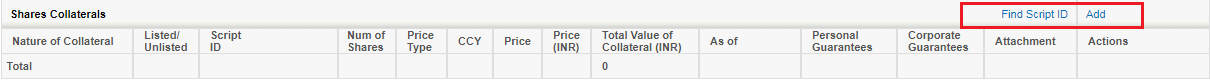

Shares Collaterals : Unlock the value of your stocks use the Shares As Collateral option and seize every

trading opportunity. Shares As Collateral is a facility which allows you to create a trading limit by holding your

existing stocks in the demat account for trading in e-margin or Future and Options segment. If you see a trading

opportunity in stocks in the F&O segment and you don't have the funds to place the order, you can simply create a

limit by using Shares as Collateral to trade. Then you can bring in the funds by T+1 day.

- Zero cost on collateral held in Demat.

- Enhance your buying power by utilising shares that are otherwise lying idle.

- Ability to sell shares online when blocked.

- Higher leverage

- Helps in grabbing the short-term opportunity in the market, without incremental investments.

Unsecured/Others Collaterals : An unsecured Collaterals is a Collaterals that is issued and supported only by

the borrower's creditworthiness, rather than by any type of collateral. Because unsecured loans, sometimes referred

to as signature loans or personal loans, are obtained without the use of property as collateral, the terms of such

loans, including approval and receipt, are most often contingent on the borrower's credit score. Borrowers must

generally have high credit ratings to be approved for certain unsecured loans.

Unsecured loans are the reverse of secured loans. They include things like credit cards, student loans, or personal

(signature) loans. Lenders take more of a risk by making this loan, because there is no asset to recover in case of

default. This is why the interest rates are higher. If you are turned down for unsecured credit, you may still be

able to obtain secured loans. But you must have something of value that can be used as collateral.

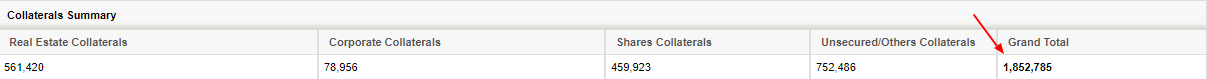

Collaterals Summary : This panel display consolidated value of Real Estate Collaterals, Corporate

Collaterals, Shares Collaterals, and Unsecured/Others Collaterals.